|

HOME | ABOUT US | SOLUTIONS | COVERAGE | CONTACT |

Electronic invoicing in Latin America is characterized by composite validation rules and the requirement of real-time clearing of invoice documents through the systems of a national tax administration. This is commonly referred to as the invoice clearance model.

The clearance model provides tax administrators with the information needed to audit companies and to combat informality and tax evasion, and it simplifies companies' tax reporting and audit procedures. To accomplish this, clearance countries have expressed their legal tax regulations through technical specifications, with each type of fiscal document consisting of a technical syntax and a set of compliance rules and requirements.

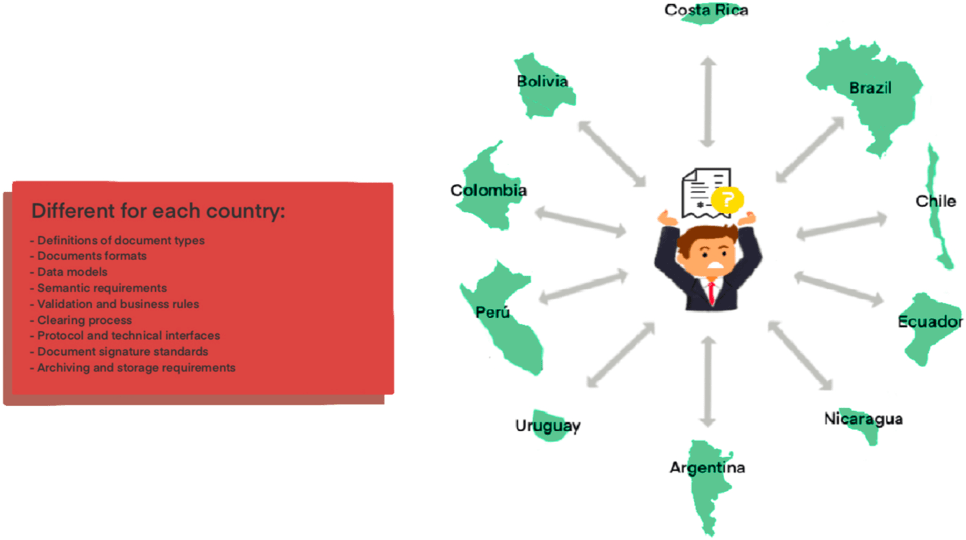

While the clearance model provides benefits both for tax administrations and for tax payers, it also has its complications - mainly the high technological barrier for its technical implementation. In Latin America, each country has created its own standards and its own specifications for their national clearance and compliance, resulting in the complexity of having to implement, test and maintain tens of different technical interfaces, hundreds of different document types and standards, and hundreds of thousands of validation and business rules for regional-wide electronic invoicing compliance.

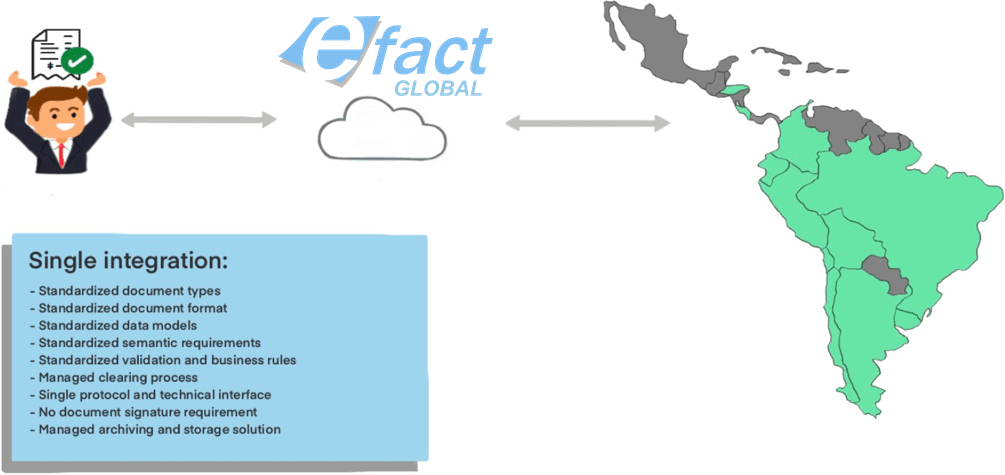

Efact Global's solutions and products are built to solve this complexity. Through a single integration to a standardized interface and using a single standardized document standard, our customers can issue their documents in all countries supported. The same integration can be used to validate the legal status of incoming invoices from suppliers, a common regulatory requirement for buyers in many Latin American countries.

Efact Global's Invoice Clearance platform is a single gateway solution for issuing electronic invoices in Latin America. Our platform is non-invasive and can be provided to e-invoicing service providers as an OEM solution, integrating into existing solutions and products to provide support for the issuing of fiscal documents in supported countries.

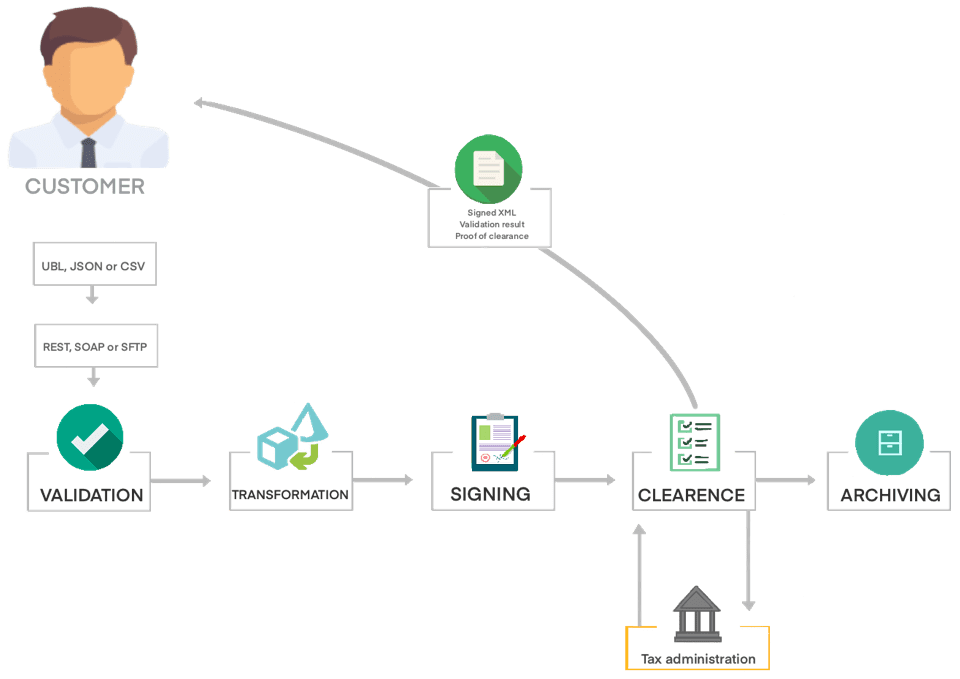

The turn-key solution provides customers with a single technical gateway where all document types can be sent using a single document format standard. Efact Global validates that document comply with local business rules, transforms the document to comply with national technical requirements, signs the document in accordance with regulatory requirements, and clears the document by integrating to the national tax administrator:

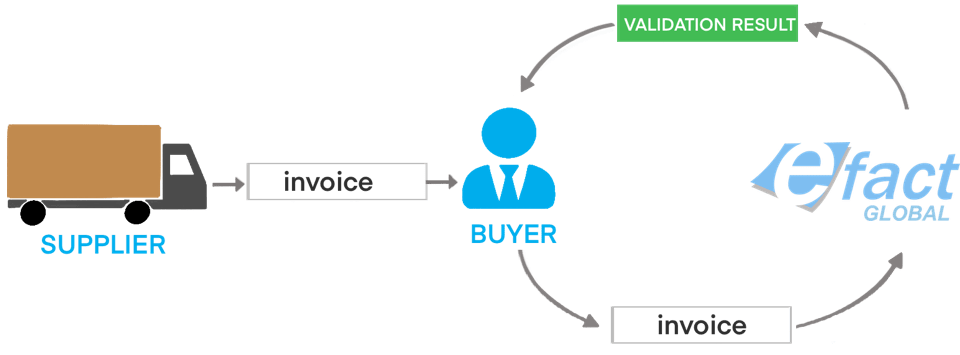

Validation of invoices from suppliers is an often overlooked yet critical component of a e-invoicing clearance country. Buyers who unintentionally accepts an invalid invoice from a supplier will in the best of cases not be able to use the fiscal credit, and in worst case be fined or otherwise sanctioned by the tax administrator. Tax administrators provide means for automating the validation of invoices; however, the mechanisms differ from country to country as does the technical format of the invoices.

Efact Global's Invoice Validation platform provides a single interface for validating invoices issued by Latin American suppliers. The original invoice document is sent to the platform along with the clearance claim, and Efact Global responds with the result of the validation: